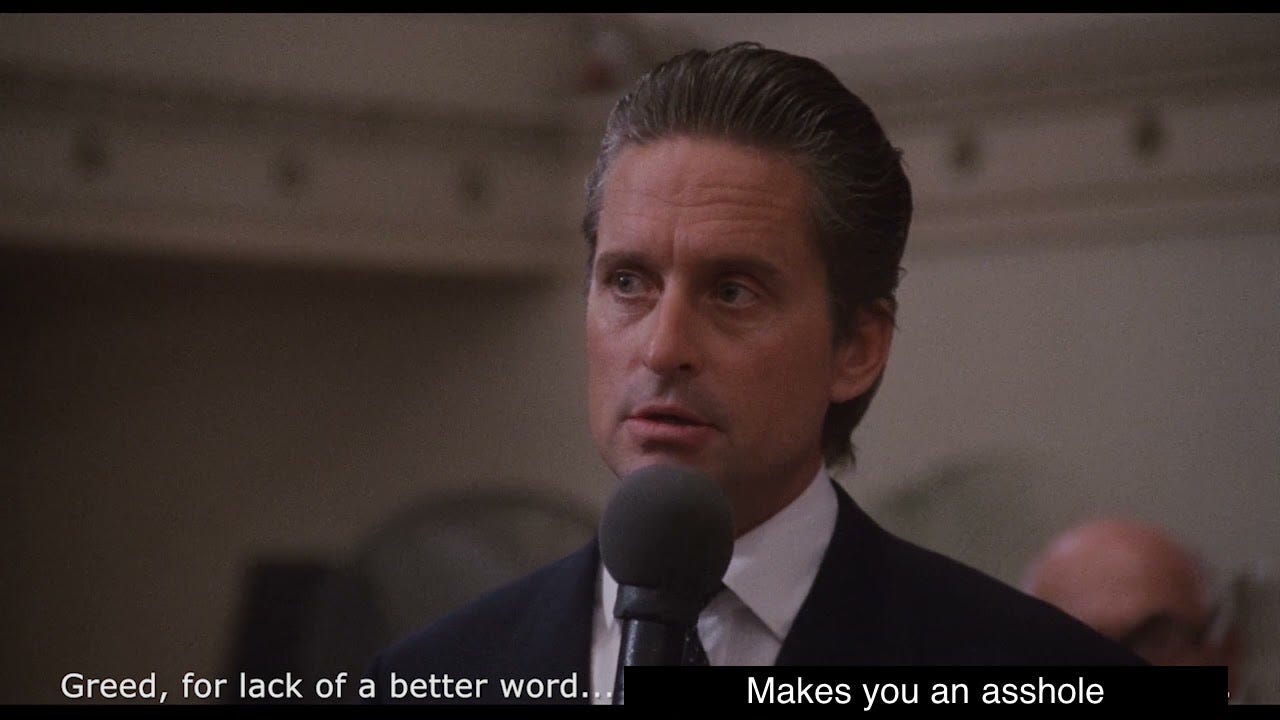

There’s a term floating around called “greedflation,” which refers to the possibility that corporations may be using the specter of inflation to raise prices and then blame inflation. It’s controversial. Some say it’s a conspiracy theory, and the increase in prices is really just a question of supply and demand: More money chasing fewer goods after rounds of government spending and a pandemic that disrupted supply chains, which increased the price of “input” goods, or the cost of items producers have to buy to create what consumers ultimately purchase.

But recently, the idea of greedflation has taken hold with what you might call “serious people”—central bankers pointing out that price increases for consumers are larger than price increases for inputs. Maybe, they say now, corporations are in fact exacerbating inflation. Bloomberg News—not exactly a scion of bastion of communist economic rhetoric—published this headline on August 25th, 2022: US Corporate Profits Soar With Margins at Widest Since 1950. It included these sentences: “The data show that companies overall have comfortably been able to pass on their rising cost of materials and labor to consumers. With household budgets squeezed by the rising cost of living, some firms have been able to offset any slip in demand by charging more to the customers they’ve retained—though others like Target Corp. saw their inventories swell and were forced to discount prices in order to clear them.”

Despite this, the idea of rapacious capitalism taking advantage of consumers is only now, apparently, moving out of “fringe” theory territory. Instead, along the way, we’ve contorted ourselves into thinking that, actually, wages might be the problem. Like this story in USA Today from October 2022, months after data showed that the issue was likely corporate greed: Good news is wages are rising. Unfortunately, that may also be bad news. Here's why. Workers demand higher wages, which leads to higher inflation, which leads to workers demanding still higher wages—a wage-spiral, in financial parlance. One financial consultancy executive told the paper: “A company has no choice but to pass on those costs to the consumer. That feeds consumer prices, and ‘round and ’round we go!”

The Masters of the Universe who spend their days doing nothing but moving money from one account to the other are quick to blame normal people who have normal jobs for everything. Or that ready-made bogeyman, the Federal Reserve, for printing too much money. Business people are just engaged in rational competition while workers are doing crazy things like forming unions and demanding a living wage. No less a person than Adam Smith himself called this “ignorant” in his landmark work Wealth of Nations, which I’m convinced is one of the most-cited, least-read works of all time.

“We rarely hear, it has been said, of the combinations of masters, though frequently of those of workmen. But whoever imagines, upon this account, that masters rarely combine, is as ignorant of the world as of the subject. Masters are always and everywhere in a sort of tacit, but constant and uniform combination, not to raise the wages of labour above their actual rate. To violate this combination is everywhere a most unpopular action, and a sort of reproach to a master among his neighbours and equals. We seldom, indeed, hear of this combination, because it is the usual, and one may say, the natural state of things, which nobody ever hears of. Masters, too, sometimes enter into particular combinations to sink the wages of labour even below this rate. These are always conducted with the utmost silence and secrecy, till the moment of execution, and when the workmen yield, as they sometimes do, without resistance, though severely felt by them, they are never heard of by other people.”

TL;DR: If you think that corporations do not attempt to ensure wages are as low as possible or even lower than the market dictates, you are a fool. And there are a lot of fools with a lot of power these days.

At this point I should probably justify how this is a Rhapsody essay about the human experience. Here’s why: Throughout history, one of the primary ways ruling classes have controlled things is by creating their disciplines and their own languages replete with customs and rituals and knowledge that they withhold from normal people yet cite to justify their own position. Think about centuries of the Catholic Church holding masses all over the known world in Latin even though nobody spoke Latin, and then exploiting this in the form of things like indulgences—telling people that if they pay money, they can be absolved of their sins and get to Heaven. That’s just one example.

What grinds my gears is how some economists often treat economics as if it is a natural science with observable laws that have passed through the rigor of the scientific method. To be crystal clear, the problem is not economics itself, the problem is when it crystallizes into dogma, which can then be used to uphold exploitative systems of labor. For example, Curtis Dubay, the Chief Economist at the U.S. Chamber of Commerce, argued just this month“it’s worth reiterating the obvious: there is no such thing as ‘greedflation.’” He then lists “The facts: Inflation is caused by clear and well-understood economic factors that stem from supply and demand. Prices rise when we have too many dollars chasing too few goods and services. There is nothing more complicated to the story than that.”

The story *is* more complicated than that. Inflation is the rate of increase in prices over time. Prices don’t set themselves. It’s not like the relationship between barometric pressure and rainfall or the temperature at which an element liquifies. Human beings working at companies set prices. But Dubay and the like would have us believe this is the case because models in textbooks say so, and also because it behooves the business community for consumers to believe that the business owners themselves are in no way at fault—they are just reacting “rationally” to the market.

As researchers at financial research firm TS Lombard write: “Unlike in previous episodes, when rising inflation meant rising wages and shrinking profits, margins have benefited from inflation over the past two years. Wages have risen in nominal terms, but profits have risen even more amid falling real labour costs.”

Why are profit margins rising more than wages? Because people at companies who decide what things cost are ensuring that is the case. And as Alexandra Scaggs writes for the Financial Times, this is because “the concentration of pricing power and resources among S&P 500 companies makes it easier for them to wring out profits in good and bad times, and those profits often come at the expense of individuals’ incomes and living standards.”

Call it whatever you want, but at the end of the day it’s corporate greed being passed on to workers and consumers. In fact, some are now saying not only is greedflation real—it is good. Economists who point to models from microeconomic textbooks who want us all to believe otherwise are simply trying to employ specialized language to over complicate a simple reality and have us believe we simply shouldn’t trust our eyes (or real world evidence) because they know better. Don’t get me wrong, there are times I really want expertise, like when I had brain surgery. But this is not that kind of expertise.

I have been saying for a long time, companies never cut into their profits, even to benefit their employees, because of greed. They make 1 billion this year, and they need 2 billion next year. Greedflation exists!!!